Definition of ROS

Return on sales (ros calculation) is a financial ratio that demonstrates how effectively a business can create operating profit from its revenue. A rising Return on Sale (ROS finance) shows that the company is expanding, whereas a dropping Return on Sale suggests that the company is shrinking. The operating profit margin and the return on investment (ROI) are inextricably linked to the ROS company.

In business, all organizations’ primary goal is to create a profit so that they can use that money to expand their operations. This will boost their profit margins even further. As a result, they analyze the profitability of their firm on a regular basis in order to understand their organization’s operating capabilities.

Return on sale (ROS) is a metric used by businesses to assess their operational capability. Return on sale, return on sale formula, return on sale uses, and how to calculate return on sale formula using an example are all covered in this article. I hope this has helped you have a better knowledge of the subject. Let’s get this party started.

What does ROS stand for Investment (what is ROS in finance)?

Operating profit margin is another term for return on the sale. It demonstrates how much of an organization’s overall income is made up of operating profit. Investing in a business allows it to grow.

Production costs, facility rent, staff salaries and wages, and the cost of raw materials utilized to manufacture a product are all expenses. Similarly, a firm has a number of expenses that must be recovered before it can generate a profit from sales.

If your business isn’t even generating enough money to cover your investment, it’s on the verge of going out of business. The return on sale, on the other hand, is the percentage of profit made by the company after the initial investment has been recovered.

Read more: NetbaseQuid Offers Useful Advice About Social Listening

This ratio is crucial because it tells you how much money a company is making on its investment. Creditors and investors use this information to compare a company’s success from one period to the next. They can also use this information to evaluate the performance of two companies in the same market and invest in the one that has a better track record of profit.

Because it assesses both efficiency and profitability, the value of Return on Investment (ROS) can be regarded as both. It assesses how effective a corporation is at generating profit from its resources. If a company’s efficiency and price to revenue ratio are both improved, profits will rise.

What is a Return on Investment (ROI)?

Operating profit margin is another term for return on the sale. It demonstrates how much of an organization’s overall income is made up of operating profit. Investing in a business allows it to grow.

Production costs, facility rent, staff salaries and wages, and the cost of raw materials utilized to manufacture a product are all expenses. Similarly, a firm has a number of expenses that must be recovered before it can generate a profit from net income/sales.

If your business isn’t even generating enough money to cover your investment, it’s on the verge of going out of business. Non-operating expenses such as taxes and interest are not included in the return on sales calculation because they are not considered operating expenses.

As a result, the return on sales value provides a clear picture of the profit generated by the company’s core operations, allowing investors to decide whether the core operations are lucrative or not.

How To Calculate Return On Sales

- Take the first step. Calculate operating costs like inventory, marketing, rent, and machinery, among other things (all these costs can be obtained easily from the income statement). Steps how to find gross profit.

- Determine the company’s net sales in the following step. (You can also get this information from the income statement.)

- Subtract operational expenses from net sales to arrive at operating profit.

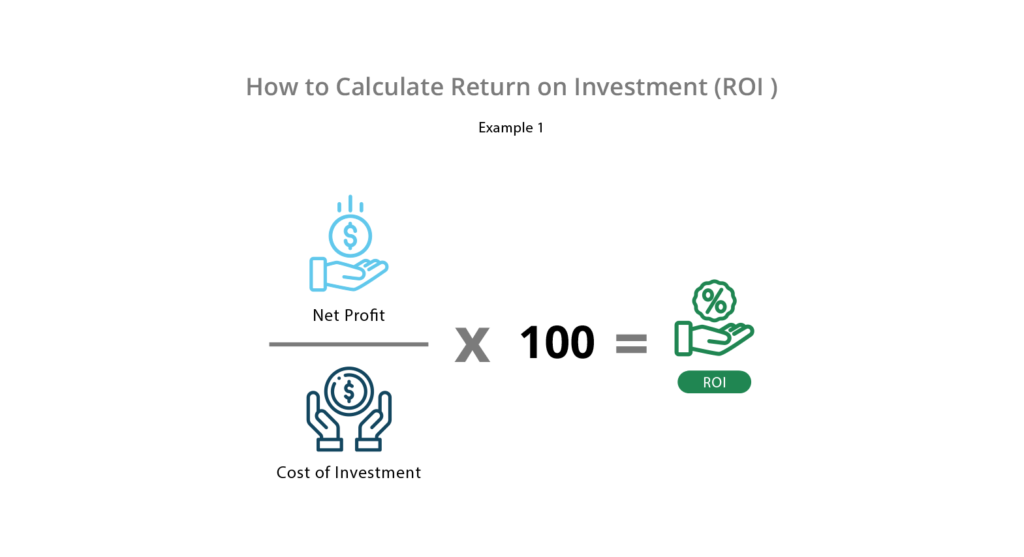

- Return on sale is calculated by dividing operating profit by net sales value, which reveals how much profit a company makes from its total sales revenue. (This will provide you the return-on-investment ratio.)

- To calculate the percentage value of return on sales, multiply the figure obtained by 100 percent. (Return On Sales Formula)

Operating Profit = Net Sales – Operating Expenses

Example

Let’s pretend that a corporation has $30,000 in total operating expenses and $50,000 in net revenue calculation.

how to find total revenue

The company’s operational profit is

$50,000 – $30,000 = $20,000,

and the company’s Return on Sales ratio is

$20,000 / $50,000 = 0.4, with a 40% return on sales.

This how to how to calculate revenue

A company with $50,000 in revenue and $30,000 in operating expenses is more profitable than one with $90,000 in revenue and $80,000 in operating expenses. A corporation that has a higher return on sales has the ability to efficiently use its resources to create a sales profit return on sales formula.

Read more: What is Innovation? Definition, Importance, Types of Innovation

Return on Sale and Its Applications

- Return on sales is a metric that is used to compare two businesses in the same industry. The reason for this is that the operational costs of two companies in the same industry can differ significantly. A company that deals in grocery retail, for example, has a lower profit margin than one that deals in cosmetics.

- Return on Sales is a metric that is used to determine whether or not a business is profitable. Because, in the end, practically every business’s most essential goal is to make a profit, and return on sales (ROS) can help them comprehend this better.

- Return on Sales is also used to compare the current fiscal year’s performance to the previous year’s performance. This aids the organization in determining the progress trend.

- Return on sales can also be used to compare the real profit made by one firm with that of another company in the same industry, regardless of the size of the industry’s operation. This information aids investors in making investment decisions as well as providing a general estimate of the sales profit they may expect from investing in a specific company.

Return on Sales Has Its Limitations

Return on Sales Should Only Be Used to Compare Companies in the Same Industry Return on sales should only be used to compare companies in the same industry, particularly those with similar business structures and yearly sales figures. Companies in diverse industries with vastly different business structures have vastly varying operating margins, making comparisons with EBIT in the numerator misleading.

Many analysts utilize a profitability measure that excludes the effects of financing, accounting, and tax policies to make it easier to evaluate sales efficiency between different companies and industries: profits before interest, taxes, depreciation, and amortization (EBITDA). The operating margins of large manufacturing firms and heavy industrial firms, for example, are more comparable when depreciation is factored in.

Because it removes non-cash items like depreciation, EBITDA is sometimes used as a proxy for operating cash flow. However, EBITDA is not the same as cash flow. This is because, unlike operating cash flow, it does not account for any rise in working capital or capital expenditures required to support production and maintain a company’s asset base.

Read more: What is Enterprise Architecture (EA) and why is it an important full guide?

Bottom Line of Return On Sales

- Return on Sales (ROS technology) is a metric that measures a company’s operational performance.

- A higher return on sales reflects a company’s increased efficiency and vice versa.

- Return on sales is a term that can only be applied to organizations that are in the same industry.

- The ROS model allows you to compare a company’s current performance to that of earlier periods.

- For well-established businesses, return on sales is more accurate.